Connecting Demand to Supply: 2021 Food Supply Chain Tech Outlook

The following article is Culterra Capital's look at the Food supply chain tech market & predictions for 2021.

We have been covering the Food Tech and AgTech sectors for the past decade, yet COVID-19 thrust the food supply chain into the spotlight as we could have never anticipated. Against the backdrop of the current pandemic, as well as nearly $500 billion in annual food waste occurring from food harvest to distribution and retail globally, it was time for a dive deep into the technology that will shape the food supply chain in 2021 and beyond.

For those also following the tech-driven food sector it is no surprise that, to-date, most investment and innovation fanfare have been focused on the food system end-points of AgTech and Food Tech. However after our recent odyssey into the Food Supply Chain Tech category, it is quite clear to us that there is a tremendous, untapped opportunity for vertical-specific technology companies which are focused on serving the unique needs of the food supply chain.

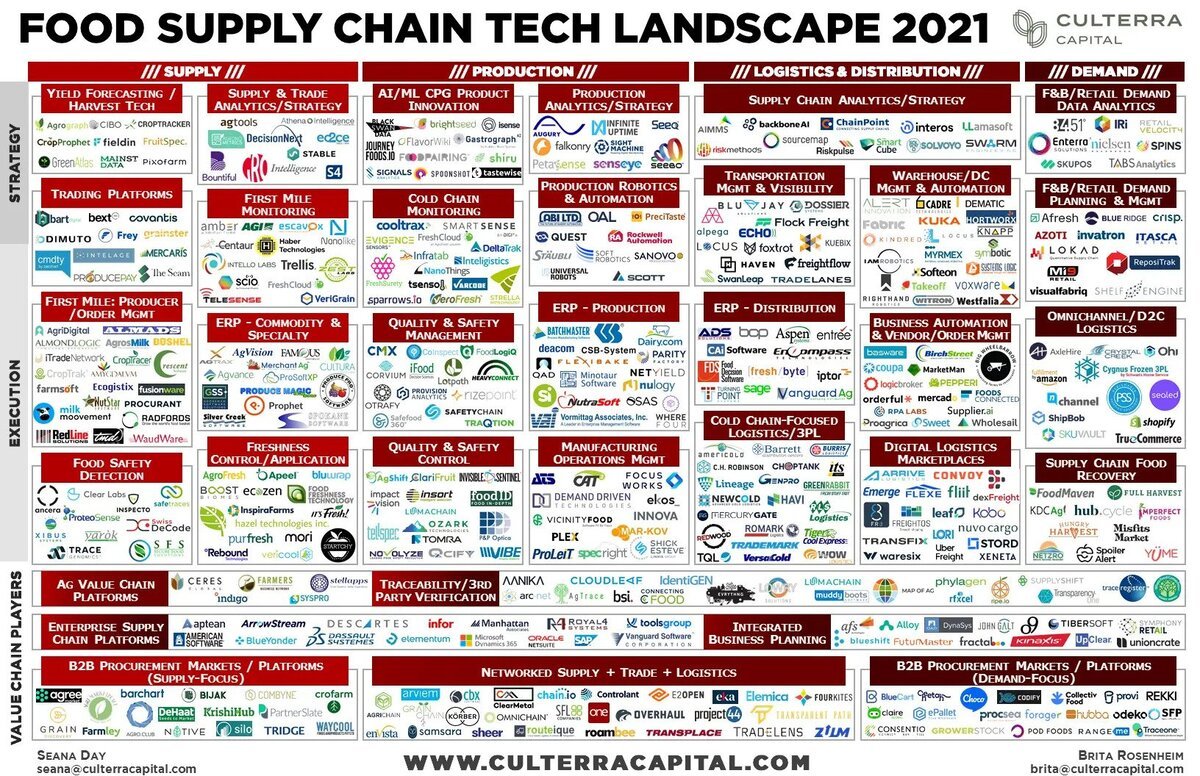

It is with this sense of urgency and optimism about new frontiers of innovation, agility and investment that we launch Culterra Capital’s inaugural 2021 Food Supply Chain Tech Landscape.

For the purposes of this analysis we have highlighted a handful of predictions for the year to come, as well as emerging themes and key innovation trends that we believe will continue to impact the four supply chain pillars (Supply, Production, Logistics/Distribution, Demand).

While we cover a number of digitalisation-driven opportunities for food system participants to strengthen their resilience, profitability and agility, we will reserve deeper dives into the sector-specific drivers and practical adoption obstacles in later reports. But first, a brief primer on navigating the landscape before we dig into our key takeaways below:

How to Navigate the 2021 Food Supply Chain Tech Landscape

“Food Supply Chain Tech” here generally refers to the technology enabling the processes and movement that occur between the farm gate and the loading dock/back door of the grocery retailer/food service provider.

This is a heatmap, not a comprehensive catalog: While clearly not exhaustive, this map is meant to illustrate the layers and variety of technology solutions, early stage to mature, and primarily enterprise or B2B-focused. We have generally filtered the companies based on their food and ag customer base, and while mainly US-focused, have included a handful of global companies. Our FarmTech (inside the farm gate) and Food Tech (retail/food service/D2C) landscapes cover the other end points of the food system.

IT-Driven Focus: The landscape focuses predominantly on digital technology-related companies, and although hardware is (mostly) unplugged from this landscape, there is a strong recognition that hardware is an essential part of the technology landscape, especially as it relates to key trends around Industry 4.0 and networked equipment.

In order for us to drive down and understand the many, extraordinarily complex functions involved in the food supply chain, we have organised the market around four key pillars of activity:

First Mile (Supply)

Production / Food Processing (primary and secondary)

Distribution and Logistics

Retail / Food Service / D2C (Demand)

Across the bottom of the landscape, we included value chain players which integrate across multiple pillars.

Is Data Automation Bringing Sexy Back?

The overall food and ag industries are among the lowest penetration of digitalisation relative to every other sector of the global economy. And while it is well understood across the food industry that modernisation and investment in data infrastructure represent a necessary and essential first step, the challenge of “going paperless” is still a real hurdle.

Yes, we understand that “going paperless” is less sexy than, perhaps, micro-fulfilment robotics. But increased workflow and data automation solutions in the food supply chain holds significant power to help the food supply chain leapfrog into digitalisation.

Data automation leverages ML/AI to digitise and automate document processing and manual back office processes like managing vendors, suppliers, contracts, key communications, appointments, and so on. Because of the highly fragmented nature and sprawling ecosystems, data automation brings critical resource management, accuracy and most importantly, an underlying digital foundation to the food supply chain.

Examples of workflow and data automation solutions focused on the food sector include Proagrica, Big Wheelbarrow, and Wholesail.

A digital foundation is also a key enabler of business innovation for participants up and down the Food and Ag system, like data-driven demand prediction. For example, today our food system is fundamentally supply-driven. Crops or livestock are harvested at a point in the season, and the producer is a price taker. Producers have long sought to overcome this risk / reward imbalance by vertically integrating, and we continue to see that from all sides whether it is Kroger or Walmart integrating their dairy supply chain, or Driscoll’s and Naturipe branded berries.

Those players who have access to demand data from the retailers, consumers and foodservice outlets, and can control several steps in the supply chain, can better understand when and where to sell, as well as how to maximise their profit through demand insights.

Similarly, with better demand data flowing into the distribution, logistics and production pillars, companies can better manage over / underproduction and reduce waste, while also improving the utilisation of their own assets (equipment, labor, utilities, storage, etc.).

MOM Knows Best?

Mostly overlooked by venture capital investors, there has been a dearth of significant outside investment in food production and manufacturing business tools, like Manufacturing Operations Management (MOM) software, which represents a collection of systems for managing end-to-end manufacturing processes and automation. The core MOM subsystems include:

MRP (Material Requirements Planning): packaging, raw material planning, procurement scheduling, etc.;

MES (Manufacturing Execution Systems): used to track and document the transformation of raw materials to finished goods; and

Other categories of Enterprise Asset Management which fall into this broader manufacturing tech category.

Largely the domain of established and legacy software companies, vertical, food-focused MOM and Enterprise Resource Planning (ERP) systems are becoming increasingly recognised for their potential to supply foundational, batch-level data for AI/ML-driven analytics, more nimble food production processes, greater workflow automation, optimisation of procurement, and so on.

At the same time, the broader technology landscape is shifting from a traditional manufacturing automation stack (ERP/MOM) to a IIoT stack (Industrial Internet of Things) which leverages a combination of app development, platform cloud, connectivity, and hardware. This intelligent manufacturing stack will be central to unlocking the promise of a more agile, visible and collaborative food supply chain.

In looking ahead, it is important for tech innovators to understand both the complexity and opportunity stemming from ERP/MOM/IIoT stacks, as the critical data captured in these subsystems has multiple beneficiaries and is also poised to enable business model innovation across the value chain, from ag producers, to manufacturers, distributors and beyond.

As an example, it is generally a challenge for ag producers to track and trace raw materials once they hit the processor (both primary and secondary). In food value streams like protein (animal) processing, automation and batch processing are hard to achieve given the nature of tracking disassembly (“primary” – one carcass that turns in hundreds of cuts or many SKUs) vs. assembly (“secondary” – a dozen ingredients combined into one product or SKU).

However, increasingly sophisticated and connected MOM systems are beginning to deliver batch-level tracking which makes verification of farming practices (regenerative, non-GMO, organic, etc), genetics / genealogy or origin claims easier to authenticate.

This is one of many examples that reinforces our belief that domain-specific manufacturing software and systems for the food and beverage sector are essential. The level of tracking complexity and data integration can be dizzying, but there are a handful of innovative companies that are building solid, scalable businesses such as Dairy.com, ParityFactory, Wherefour, and Food ID, among others in the space.

The Cold Chain is Heating Up

As noted in The Spoon’s coverage, the pandemic shifted a large number of people to online grocery shopping, and many of those new online shoppers will continue to shop online. Notably, this surge in digital grocery orders also included more online fresh / perishables purchases, both in retail environments as well as direct to consumer (D2C). This growth is expected to continue even as grocery shoppers migrate back to in-store shopping. For context, e-commerce grocery is now expected to account for at least 21.5% of US grocery sales by 2025, (up from a pre-Covid prediction of 13.5%).

We believe this increased demand will catalyse cold chain suppliers and 3PLs to meaningfully bolster their digital infrastructure and investment in tech solutions, as we have seen with high flyers like Lineage Logistics. They will feel greater pressure to adapt to the dynamic demands of buyers, such as faster speed of delivery, decreased waste, real-time inventory visibility and traceability of products.

These objectives are not possible without integration and interoperability solutions which create the linkages necessary to overcome the massive amounts of existing siloed data. These solutions layer on top of existing supply chain planning, execution and equipment control systems, integrating them to further optimise for analysis and real time planning / visibility across various parts of the supply chain.

Without harmonised data, the cold chain can’t truly unlock efficiency or capacity, nor adequately respond to supply-demand volatility. Tightly linked systems to share this data can have a significant impact on the shelf life of perishable products (reducing waste), the assurance of quality (product, producer or marketplace differentiation), and support agility in demand-driven forecasting. Examples of startups focused on providing innovative solutions in this sector include AgroFresh’s Fresh Cloud, Backbone AI, and Afresh.

Looking Ahead to 2021

The food supply chain differs in some respects from our traditional understanding of Food Tech and AgTech because it encompasses industries with relatively well-established players and technologies, many of which are horizontal software (with a multi-industry offering) and logistics companies. Due to this, as well as the highly-regulated and labor intensive nature of the supply chain, historically it has been a more difficult industry for nimble start-ups to penetrate.

Today, we see the majority of participants across the food supply chain setting the table with foundational data and digitising basic workflows. This is the essential first step. Basic digitalisation, strengthening collaboration tools, automating some data sharing, and looking for ways to streamline labor will be key themes in 2021.

To be sure, COVID-19 revealed accelerating demand for tech ready to scale (vs. new innovation). Yet that is not the end of the story. We see most of the exciting food supply tech innovation springing up around the perimeters of the landscape, particularly from analytics and strategy plays within First Mile (Supply) and Retail / Food Service / D2C (Demand).

For start-ups, those that can differentiate themselves with proprietary, unique data cleansing tools have an important edge. As we know from AgTech and Food Tech, this is one of the principal activities that many innovative companies spend vast amounts of time working on. The same holds here in the Food Supply Chain.